SWIFT system is used for Bank to Bank communication and Bank to Corporate communication. There are different type of Swift messages format related to specific purpose. This article focuses on Category 7 message.

Category 7 supports messages which are exchanged between Banks involved in the Documentary Credit and guarantee business.

Post RBI’s ban on Letter of Comfort and Letter of Undertaking, importers have started using Letter of Credit and Suppliers Credit instead of Buyer’s Credit . This article is to help Importers understand different type of swift messages used for the said product.

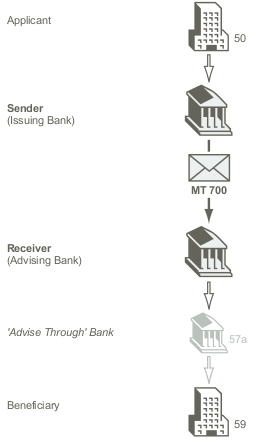

MT 700 Issue of a Documentary Credit

This message is sent by the issuing bank to the advising bank. It is used to provide the terms and conditions of a documentary credit.

MT 701 Issue of a Documentary Credit

This message is sent in addition to an MT 700 Issue of a Documentary Credit, when the information in the documentary credit exceeds the maximum input message length of the MT 700.

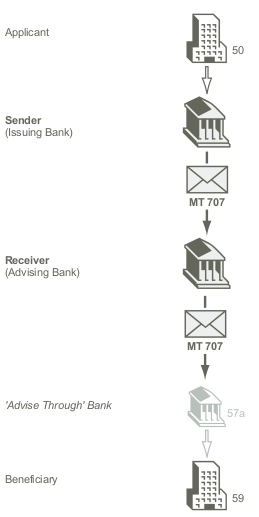

MT 707, 708 Amendment to a Documentary Credit

It is used to inform the Receiver about amendments to the terms and conditions of a documentary credit issued by the Sender or by a third bank. The amendment is to be considered as part of the documentary credit.

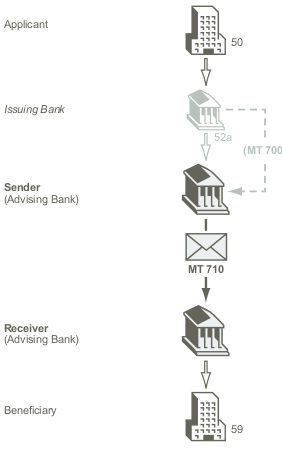

MT 710 Advice of a Third Bank’s or a Non-Bank’s Documentary Credit

This message is sent by an advising bank, which has received a documentary credit from the issuing bank or the non-bank issuer, to the bank advising the beneficiary or another advising bank. It is used to advise the Receiver about the terms and conditions of a documentary credit.

MT 732 Advice of Discharge

This message is sent by the issuing bank to the paying/negotiating or accepting bank. It may also be sent by the paying / accepting / negotiating bank to the bank from which it has received documents. It is used to advise the Receiver that the documents received with discrepancies have been taken up.

MT 734 Advice of Refusal

This message is sent by the issuing bank to the bank from which it has received documents related to a documentary credit. It may also be sent by the bank nominated to pay/accept/negotiate/incur a deferred payment undertaking to the bank from which it has received documents.

It is used to advise the Receiver that the Sender considers the documents, as they appear on their face, not to be in accordance with the terms and conditions of the credit and that, consequently, it refuses them for the discrepancies stated. The Sender also provides the Receiver with details regarding the disposal of the documents.

This message type may also be used for claiming a refund.

MT 740 Authorisation to Reimburse

This message is sent by the issuing bank to the reimbursing bank.

It is used to request the Receiver to honour claims for reimbursement of payment(s) or negotiation(s) under a documentary credit.

The MT 740 authorises the reimbursing bank to debit the account of the Sender, or one of the Sender’s branches if so indicated, for reimbursements effected in accordance with the instructions in the MT 740.

MT 742 Reimbursement Claim

This message is sent by the paying/negotiating bank to the bank authorised to reimburse the Sender for its payments/negotiations.

It is used to claim reimbursement of payment(s) or negotiation(s) under a documentary credit, as relevant to the reimbursing bank.

MT 750 Advice of Discrepancy

This message is sent by the bank to which documents have been presented, to the issuing bank. It may also be sent to a bank nominated to pay/accept/negotiate/incur a deferred payment undertaking.

It is used to advise the Receiver that documents which have been presented are not in accordance with the terms and conditions of the credit.

The MT 750 is a request for authorisation to take up documents. Authorisation may be provided using an MT 752 Authorisation to Pay, Accept or Negotiate; a negative reply to the request may be provided using an MT 796 Answers.

MT 752 Authorisation to Pay, Accept or Negotiate

This message is sent by the issuing bank, or the nominated bank if so authorised by the issuing bank, to a paying/accepting/negotiating bank in response to a request for authorisation to pay/accept/negotiate/incur a deferred payment undertaking previously requested via an MT 750 Advice of Discrepancy or otherwise.

It is used to advise the Receiver that documents may be taken up, notwithstanding the discrepancies, provided they are otherwise in order.

MT 754 Advice of Payment / Acceptance / Negotiation

This message is sent by the paying, accepting or negotiating bank, or the bank incurring a deferred payment undertaking, to the issuing bank. It may also be sent by the bank to which documents have been presented to a bank that has been nominated to pay/accept.

It is used to advise the Receiver that documents were presented in accordance with the credit terms and are being forwarded as instructed.

The MT 754 may also be used:

- for the settlement of the payment/negotiation

- as a pre-notification of a reimbursement claim from the claiming bank to the issuing bank

- as a pre-debit notification from the claiming bank to the issuing bank.

Note: Where a pre-debit notification from the reimbursing bank to the issuing bank is required, banks should use the MT 799 Free Format message, specifying the future date of debit.

MT 756 Advice of Reimbursement or Payment

This message is sent by the issuing bank to the bank from which it has received documents or by the reimbursing bank to the bank from which it has received a reimbursement claim. It may also be sent by the bank nominated to pay/accept/negotiate/incur a deferred payment undertaking to the bank from which it has received documents.

It is used to advise the Receiver about reimbursement or payment, to that bank, for a drawing under a documentary credit for which no specific reimbursement instructions or payment provisions were provided.

The account relationship between the Sender and the Receiver is used unless otherwise expressly stated in the message.

MT 759 Ancillary Trade Structured Message

This message is sent to request or to provide information, such as a fraud alert or a financing request, concerning an existing trade transaction such as a documentary credit, demand guarantee, standby letter of credit or an undertaking (for example, a guarantee, surety, etc.).

This message must not be used where an existing MT message is available, and it should be used rather than the MT 799.

MT 790 Advice of Charges, Interest and Other Adjustments

This message type is sent by an account servicing institution to the account owner.

It is used to advise charges, interest or other adjustments which have been debited or credited to the account owner’s account. It provides details of charges which are previously unknown to the Receiver.

MT 791 Request for Payment of Charges, Interest and Other Expenses

This message type is sent by a financial institution to another financial institution.

It is used to request the payment of charges, interest and/or other expenses which are previously unknown to the Receiver.

MT 792 Request for Cancellation

This message is:

- sent by a financial institution to request a second financial institution to consider cancellation of the SWIFT message identified in the request.

- sent by a corporate customer to request a financial institution to consider cancellation of the SWIFT message identified in the request.

If the Receiver of the request for cancellation has already acted on the message for which cancellation is requested, the MT n92 asks for a retransfer, that is, reversal, with the beneficiary’s consent.

MT 795 Queries

This message type is:

- sent by a financial institution to another financial institution.

- sent by a corporate customer to a financial institution.

- sent by a financial institution to a corporate customer.

It is used to request information or clarification relating to a previous SWIFT or non-SWIFT message or to one or more transactions contained therein.

MT 796 Answers

This message type is:

- sent by one financial institution to another financial institution.

- sent by a corporate customer to a financial institution.

- sent by a financial institution to a corporate customer.

It is used to respond to an MT n95 Queries or MT n92 Request for Cancellation and other messages where no specific message type has been provided for the response. This message should use the same category digit as the related queries message or request for cancellation.

MT 799 Free Format Message

This message type is used by financial institutions to send or receive information for which another message type is not applicable.